About Credicorp

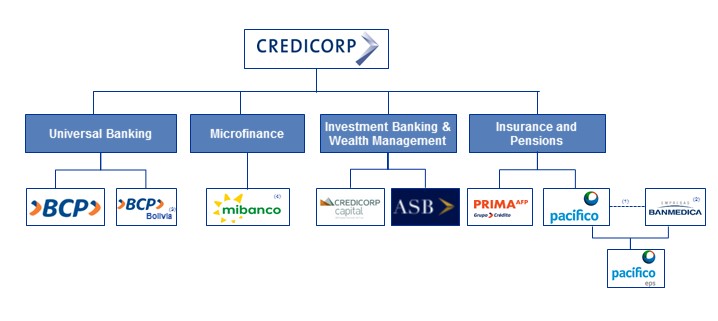

Credicorp Ltd. (NYSE: BAP) is the largest financial holding in Peru and maintains a diversified business portfolio. Credicorp’s companies are organized into four lines of business:

- Universal Banking, through Banco de Credito del Peru-BCP and Banco de Credito de Bolivia

- Microfinance, through Mibanco and Encumbra

- Insurance and Pensions, through Grupo Pacifico and Prima AFP

- Investment Banking & Wealth Management, through Credicorp Capital, Wealth Management at BCP and Atlantic Security Bank

Through its LoBs, Credicorp engages in:

- Universal Banking: Capturing deposits and providing lending to individuals and companies with a wide array of products offered through our different segments.

- Microfinance: Offering banking products tailored for micro entrepreneurs, promoting financial inclusion in underdeveloped segments. Our sales representatives also act as advisors to micro entrepreneurs.

- Insurance and Pensions: Providing a broad range of insurance products focusing on three business areas: property and casualty (P&C), life insurance and health insurance, as well as managing private retirement funds.

- Investment Banking and Wealth Management: Offering financial and transactional advisory services through our three lines of business: asset management, sales and trading, and corporate finance. We also offer wealth management products and services to affluent individuals such as investment advisory and financial planning.

(1) Agreement with Banmedica includes i) the private health insurance business, which is managed by Grupo Pacifico, and ii) the business of corporate health insurance for payroll employees and the medical services, which are managed by Banmedica.

(2) At the end of January 2018, UnitedHealth Group Inc signed a definitive agreement to buy Banmedica SA. (UnitedHealth Group now owns 96.8% of Empresas Banmedica).